Have you tried to send money via Western Union recently? If you have,

then you’ll know that unless you start lining up, like an hour before

the office opens, it’s almost impossible to send money. But why is this?

Is it an oppressive monetary policy, low reserves or could it be what the growth

economist like to call, “exogenous shocks?” Well, according to the

Governor of the Central Bank Glenford Ysaguirre it’s the third: outside

factors.

You see, in any one day, Western Union can only send out as much money

as it got the day before – and since the US financial meltdown, remittances,

meaning money sent from the states, has declined sharply. So, in any one day,

all the Western Union agencies across the country only receive something in

the range of one hundred thousand US dollars. So that becomes the quota for

the following day, meaning the limit of what they can wire out. Spread that

$100,000 across 37 agencies countrywide, and it’s not much, meaning that

if you get to a Western Union office by 8:15, you’re probably already

too late!

It’s a big change; in the past no one had ever heard of a cap

on the amount of money that can be sent out; you could visit the office anytime

during regular working hours and breezily send the money. But things have changed

and it’s been the roughest on those depend on the service for its convenience

and speed. But the Governor of the Central Bank told Jacqueline Godwin today

that there’s nothing the bank can do.

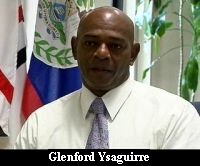

Glenford Ysaguirre, Governor - Central Bank of Belize

“There is some misinformation out there that the Central Bank has

something to do with it because we are restricting Western Union. But no, those

are conditions on their licenses from the time the license were issued. So it

is not some new condition that has gone into place; it has always been there.

It is just that in the past the remittances were sufficient to cover the outgoing

demand.

A condition of their license is that they can only sell foreign exchange

to the extent that they receive. So their outgoing remittances cannot be more

than their incoming. That is to protect and preserve the reserve position of

the country.”

Jacqueline Godwin,

“So for example if they receive twenty thousand dollars for that day,

they cannot give out more than twenty thousand dollars?”

Glenford Ysaguirre,

“Yes that is the condition. So I guess with the economic downturn

remittances coming from the States actually is on a decline and so they are

restricted or limited by that and have to adjusts the outgoing remittances to

the same magnitude.

The Central Bank is not here to source US dollars for Western Union remittances.

The commercial banks source their own US dollars and they source that through

investments coming in from customers or from proceeds from export earnings that

goes into the commercial banks and that is also available to the public through

the commercial banks. So if Western Union do not have, people have the option

of going to a commercial bank and purchasing US dollars based on availability.”

Anecdotal reports are that things have gotten so bad in the states

that in some cases Belizean are subsidizing their Belizean American relatives.

Ysaguirre says that retired Belizeans living in the States are also drawing

down on their savings in Belize. In the meantime, he’d urge those frustrated

with the Western Union cash flow constriction to try using the banks since they

have greater sources of foreign exchange.