The budget presentation will be made at a special sitting of the House

on Monday. But that special sitting will also feature the debate on four bills

concerning the banking sector The Bills of note are the Central Bank of Belize

Amendment Act, the Banks and Financial Institutions Amendment Act 2010 and the

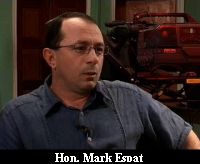

Treasury Bills Amendment Act 2010. PUP Deputy Leader Mark Espat says the bills

seek to force the Commercial Banks to buy government’s treasury bills

and notes.

Hon. Mark Espat, PUP Deputy Leader

“More importantly the government has promulgated legislation that

will now allow the Central Bank in effect to force the commercial banks to hold

specific proportions of government debt in the form of Treasury Bills and Treasury

notes. And there are those who see this as a sinister backdoor attempt to get

government’s hands on the savings of individuals and businesses because

after all if you force the commercial banks to use its deposits to purchase

government debts then it is really the savings of businesses and individuals

that are being used to fund government.

The other main thrust is that the government is increasing by double, it

is multiplying by two the ceiling on Treasury Bills which are short term debt

instruments that the government uses and it is multiplying by three the amount

of longer term Treasury Notes which are debts that the government issues. There

is a net increase of a whopping $250 million in the amount of money that the

government will be able to borrow from principally the Central Bank and forcing

commercial banks to buy its debt with the savings that are deposited in the

commercial institutions.

I think firstly Jules the government needs to come clean and I would expect

that when these Bills are debated in the House, if not before, it did not happen

last week at the House Committee that considered these Bills, that the government

comes clean and if it is seeking to increase by $250 million its source of domestic

borrowing then it should make clear that this is the way it plans to finance

the deficit, this is the way it plans to help fund government.”

We made a request for an interview in writing – as is required

from the Governor of the Central Bank Glenford Ysaguirre and got no response.

We left a voicemail for the Chairman of the Central Bank Board Allan Slusher

and also got no response.